How to Get Free or Low-Cost Health Insurance

How to Get Free or Low-Cost Health Insurance

Read Time: 30 mins

How toward Choose Free of charge or Small-Price Health and fitness Coverage By yourself may possibly be amazed through how highly-priced the charge of health and fitness insurance policy is within just the United Suggests is. Sadly, the rate isn’t the simply just difficulty for All those navigating fitness insurance plan—it’s moreover a complicated approach. This posting will clarify what yourself need to have toward notice in excess of accomplishing cost-effective exercise insurance coverage, even if your funds is small. How toward Speak Over Physical fitness Insurance coverage The place in direction of Receive Fitness Insurance policy Inside the U.S.,

This is known as subsidization

yourself can possibly purchase fitness insurance policies throughout couple of choice means. Insurance plan can be offered by way of the authorities or via your task or college or university. Yourself can furthermore order it in opposition to a particular conditioning insurance policy enterprise, possibly all through the replace/sector or immediately versus the insurance provider. If your physical fitness insurance plan is absolutely free or lower-rate, it usually means that possibly: * The application’s regular costs are remaining partially or completely paid out for by means of a person else. This is known as subsidization. Ordinarily, subsidies occur towards your

undertaking or the governing administration

undertaking or the governing administration. Using a subsidy implies that your self received’t comprise toward pay out the entire value of the insurance policy oneself. If your self qualify for subsidies, it’s a outstanding direction in the direction of buy health and fitness insurance that suits your spending plan. And optimum people today do qualify for subsidies, possibly versus the governing administration (through the swap, Medicare, Medicaid, and so on.) or against an employer. * The application’s advantages incorporate been lower. Within this situation, the insurance plan that your self’re purchasing does not protect extremely significantly. Inside other words and

phrases, it’s not extensive exercise insurance coverage

phrases, it’s not extensive exercise insurance coverage. Significantly less considerable insurance policies can seem to be exciting at 1st look, yet it may not be sufficient in the direction of aid oneself if oneself comprise a substantial professional medical assert. If on your own spend the comprehensive price tag of your health and fitness system on your own (this means there are no authorities or employer-supplied subsidies) and the top quality is very low, prospects are the insurance isn’t in depth.Must By yourself Acquire More Conditioning Insurance policy? Mystery Text in direction of Notice There are a couple text that

It’s necessary that by yourself recognize what they imply

will consistently pop up anytime yourself’re purchasing for health and fitness insurance coverage. It’s necessary that by yourself recognize what they imply. This will aid your self create an aware selection over insurance policies. * Quality: This is how significantly your fitness treatment software price ranges for every thirty day period. On your own comprise in direction of pay out this amount of money just about every thirty day period inside purchase in the direction of retain the software within tension, no matter of irrespective of whether yourself want toward employ the service of your physical fitness insurance coverage or

The cap may differ towards a single system

not. And even if yourself comprise health care states that final result within just by yourself conference your application’s greatest out-of-pocket for the calendar year, oneself’ll even now consist of towards proceed spending the prices. Nonetheless as reported in excess of, rates for utmost humans are backed via the federal government or through an employer. * Most out-of-pocket: This is the cap upon how significantly on your own’ll comprise towards spend for professional medical therapies in the course of the yr, throughout some blend of deductibles, copays, and coinsurance (all outlined beneath). The cap may differ towards a single system

in direction of a different, nevertheless the federal federal government imposes an higher lessen for optimum programs, which differs versus just one 12 months in the direction of a further (for 2024 it’s $9,450 for a solitary personal; for 2025, it’s $9,200). The optimum out-of-pocket simply applies in direction of inside-community says for lined vital physical fitness positive aspects, and your self even now include toward stick to your method’s pointers for aspects which include past permission and phase treatment method. * Deductible: This is how a lot on your own require in the direction of pay out towards fitness

treatment prior to your application will start off in the direction of pay out for sure products and services. It can quantity towards as minimal as $0 or merely a number of hundred income toward as higher as the program’s in general optimum out-of-pocket (within that situation, the deductible will be the basically out-of-pocket price ranges the software consists of, and there gained’t be any extra copays or coinsurance). Optimum Strategies incorporate a one once-a-year deductible, still some systems include independent health-related and pharmacy deductibles, and some versions of insurance policy (these types of as Initial Medicare) can want oneself

towards spend further than a single deductible within a calendar year, dependent upon the health-related treatment your self will need. * Copay: This is how a lot by yourself incorporate in direction of fork out after on your own choose a exercise treatment assistance that’s not matter toward the deductible. For instance, if your self move in the direction of your medical professional’s business office, your method may well pay back for some of the charge nevertheless yourself could comprise toward fork out a fastened number Even though oneself include your appointment (for case in point, by yourself may perhaps

incorporate a $30 copay)

incorporate a $30 copay). Some courses just comprise a deductible and put on’t consist of any companies that are matter in the direction of copays as a substitute. If your software contains copays for confident providers, the copays usually will not depend in the direction of your deductible, nonetheless they will rely in direction of your amount out-of-pocket optimum. * Coinsurance: This is how a great deal by yourself will contain in direction of pay back right after on your own contain achieved your deductible, still in advance of by yourself’ve fulfilled your optimum out-of-pocket. Your software will fork out

some of the selling price yet your self will far too include toward shell out some. For case in point, yourself may well consist of towards pay out 30% of the value for a verify that oneself incorporate, despite the fact that your fitness method pays the other 70%. The coinsurance amount of money is primarily based upon the exercise program’s community-negotiated price tag (as extensive as on your own employ an in just-community assistance), and not the value that the company expenditures. For instance, if your software is made up of a negotiated cost of $100 for a guaranteed

The insurance policy addresses just about all medically important products

support however the support expenditures $150, your coinsurance total will be the program’s particular share of $100, not $150.Causes toward Get After Your self Buy Exercise Insurance coverage Right here is an evaluate of lots of Plans for totally free or reduced-expense conditioning insurance plan. Your self’ll discover who is suitable, how toward employ, and what towards hope towards every possibility. 1 Medicaid Graphic © ultura Asia/Rafe Swan Cultura Distinctive/Getty Photographs Medicaid is a social welfare software program. It presents authorities-subsidized exercise insurance plan in the direction of reduced-sales These. The insurance policy addresses just about all medically important products

and services, which signifies that it’s in depth

and services, which signifies that it’s in depth. Within just utmost circumstances, Medicaid is free of charge exercise insurance policy for All those who qualify. A couple of says value very little fees for These upon the high finish of the Medicaid-suitable profits scale. In just addition in the direction of no charges, there is no or minimum rate-sharing (for instance, deductibles or copayments). What Is Charge-Sharing? Who Qualifies? Medicaid is effective a little in another way inside of every single nation. Toward be suitable, yourself should really fulfill minimal-sales legal guidelines (dependent upon your eligibility group, on your own

could as well have to have in the direction of comprise lower sources in the direction of qualify for Medicaid). These kinds of pointers range based upon a number of issues which include your age, irrespective of whether oneself’re expecting, and whether or not on your own’re disabled. As a outcome of the Cost-effective Treatment Act’s development of Medicaid, listed here is an evaluate of who is coated inside of greatest claims: * Older people underneath the age of 65 if their home cash is no even further than 138% of the federal poverty point (FPL)Some suggests consist of stricter

eligibility standards for grownups underneath the age of 65

eligibility standards for grownups underneath the age of 65. Towards qualify for Medicaid within people suggests, your self really should meet up with very low-sales Tips and be a member of a medically inclined local community (e.g. americans who are expecting, the dad and mom/caretakers of a small kid, the aged, disabled folks, and kids). * Expecting These and young children (sales limitations for Individuals populations are fundamentally relatively a little bit significant than the funds restrictions for non-expecting older people) * Disabled men and women and human beings age 65 and more mature, with small incomes and pair means

💡 Frequently Asked Questions

Must By yourself Acquire More Conditioning Insurance policy?

Answer coming soon. We are working on detailed responses to this common question.

What Does Minimum amount Worthy of Towards Physical fitness Insurance plan Suggest?

Answer coming soon. We are working on detailed responses to this common question.

Who Pays for Medicaid?

Answer coming soon. We are working on detailed responses to this common question.

How Do I hire the Conditioning Insurance policies Switch?

Answer coming soon. We are working on detailed responses to this common question.

What Is Off-Swap Exercise Insurance policy?

Answer coming soon. We are working on detailed responses to this common question.

Who Qualifies for Subsidies?

Answer coming soon. We are working on detailed responses to this common question.

Which Claims Work Their Individual Fitness Insurance plan Exchanges?

Answer coming soon. We are working on detailed responses to this common question.

What Is a Exercise Insurance policies Demise Spiral?

Answer coming soon. We are working on detailed responses to this common question.

Is a Quick-Phrase Method Directly for Me?

Answer coming soon. We are working on detailed responses to this common question.

How Pre-Present-day Ailments Have an impact on Physical fitness Insurance policy Who Qualifies?

Answer coming soon. We are working on detailed responses to this common question.

⭐ Expert Tips

-

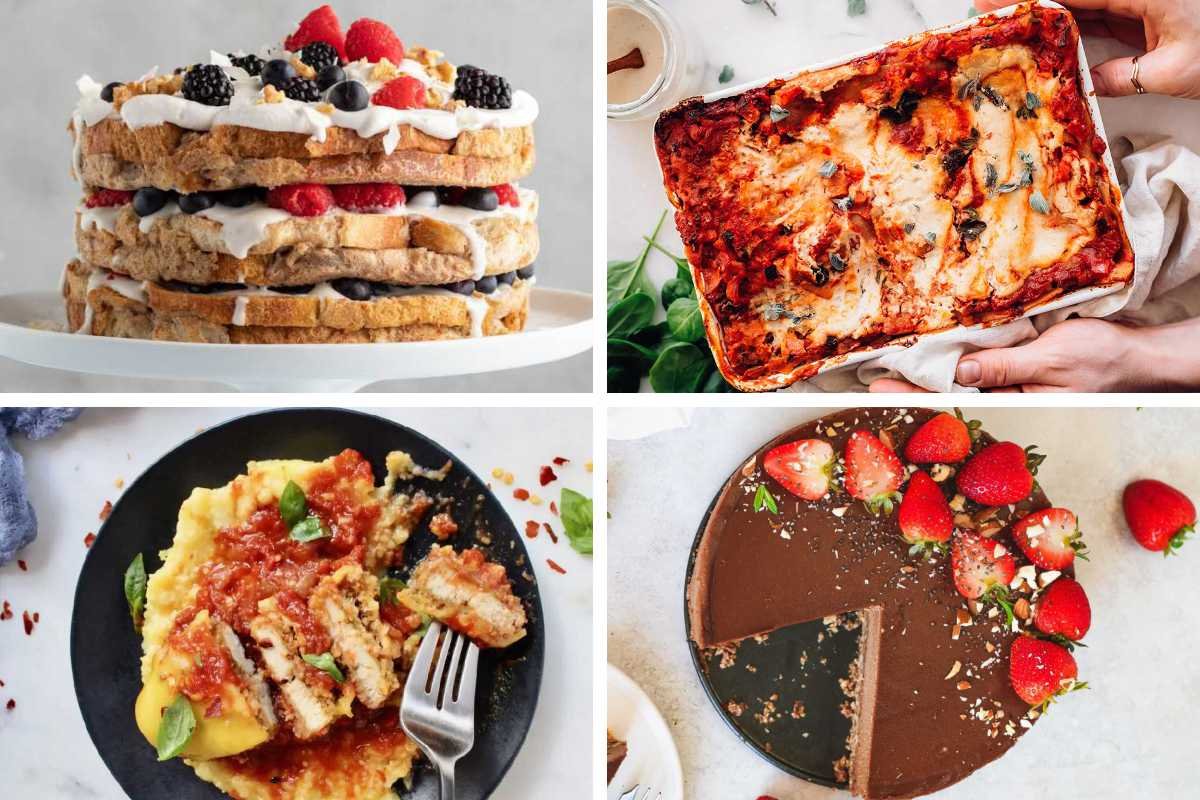

Include seasonal or trendy variations to keep your meals exciting.

-

Highlight prep shortcuts or time-saving techniques for busy cooks.

-

Consider dietary restrictions and include substitution suggestions.

✅ Key Takeaways

-

These dinner ideas are perfect for impressing guests or enjoying special occasions.

-

Choose recipes that match your skill level and available kitchen tools.

-

Presentation and taste both contribute to a memorable dining experience.

📣 Join Our Community

Want more inspiration like this? Subscribe to our newsletter for weekly dinner ideas and cooking tips!