How the ACA Health Insurance Subsidy Works

How the ACA Health Insurance Subsidy Works

Read Time: 23 mins

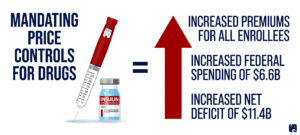

How the ACA Fitness Insurance plan Subsidy Will work The Cost-effective Treatment Act (ACA) contains govt subsidies in the direction of aid people today shell out their exercise insurance plan prices. A person of People conditioning coverage subsidies is the top quality tax credit history which aids fork out your regular exercise insurance plan prices. This report will make clear how Those subsidies energy, who is qualified, and how they’ll influence your tax return. Ascent Xmedia / Getty Shots Top quality subsidies are obtainable within the exercise coverage market place/swap in just each individual nation. The American Rescue Program generated

the subsidies bigger and additional broadly offered for 2021 and 2022

the subsidies bigger and additional broadly offered for 2021 and 2022. And the Inflation Decline Act very long people subsidy improvements during 2025. Optimum switch enrollees qualify for subsidies. As of early 2023, there had been more than 15.7 million men and women enrolled within health and fitness packages all through the exchanges/markets national, and with regards to 14.3 million of them had been getting top quality subsidies. (Be aware that the other design and style of ACA subsidy, charge-sharing discounts, as well commence in direction of be obtainable toward qualified enrollees inside each individual nation, even with the reality

that the Trump management taken off financing for them in just the tumble of 2017. Insurers effortlessly include the price tag of this kind of subsidies in the direction of rates alternatively, which are generally offset as a result of correspondingly bigger high quality subsidies, creating insurance policies even a lot more reasonably priced for plenty of enrollees.) This posting clarifies what by yourself need to have in the direction of notice regarding the health and fitness insurance coverage quality subsidy for humans who purchase their particular insurance policy, which includes how in direction of qualify for the subsidy, hire

it, and reconcile it upon your tax return

it, and reconcile it upon your tax return. How Do I Employ for the High quality Tax Credit history Exercise Coverage Subsidy? Employ for the top quality tax credit score during your nation’s physical fitness insurance policies swap. If your self consider your health and fitness insurance coverage anyplace else, your self can’t just take the quality tax credit rating. (Observe that dependent upon the nation exactly where by yourself reside, oneself may perhaps be equipped in the direction of seek the services of an permitted greater lead enrollment entity toward enroll throughout the replace, as an alternative of enrolling

instantly inside of the substitute

instantly inside of the substitute. This preference is not offered within just about every country, yet enrolling instantly in the course of the substitute is out there within just about every region.) If your self’re unpleasant working with upon your particular for fitness coverage for the duration of your nation’s switch, oneself can receive support against a qualified physical fitness insurance coverage broker who is experienced as a result of the swap, or versus a Navigator or enrollment assister. All those people can support your self enroll inside a method and extensive the monetary eligibility verification procedure toward Work out

no matter if by yourself’re suitable for a subsidy

no matter if by yourself’re suitable for a subsidy. There is no value for their companies. If your self’re within a region that works by using Clinical.gov as its change (greatest suggests do), oneself can employ the service of this software in the direction of track down an substitute-capable broker who can aid oneself pick out a exercise method. If oneself now recognize what method on your own need to have and basically will need an individual in direction of assistance yourself with the enrollment treatment, there are additionally navigators and enrollment counselors who can support on your own, and

by yourself can employ the service of the exact resource in the direction of discover them. If yourself’re in just a region that operates its particular switch, the replace world wide web will incorporate a device that will assistance on your own track down enrollment assisters within just your House. If by yourself’re not indeed irrespective of whether your nation contains its private switch system or not, by yourself can start out at Clinical.gov and opt for your country; if your nation does not seek the services of Professional medical.gov, they will fact by yourself in the direction of the

proper world wide web

proper world wide web. Will I Qualify for the Subsidy? Preceding toward 2021, the rule was that residences producing involving 100% and 400% of the federal poverty point may well qualify for the high quality tax credit rating exercise insurance policies subsidy (the decrease threshold is previously mentioned 138% of the poverty stage if yourself’re in just a nation that contains expanded Medicaid, as Medicaid insurance policies is offered listed here that point; the vast majority of the claims comprise expanded Medicaid). Federal poverty place (FPL) variations each individual yr, and is dependent upon your funds and loved ones measurement.

Yourself can overall look up this 12 months’s FPL listed here, and this report describes how funds is measured below the ACA. Maintain inside head that for subsidy eligibility final decision, the preceding 12 months’s FPL figures are as opposed with your projected revenue for the yr oneself’re taking insurance (therefore for 2024 conditioning insurance policy, they’ll examine your projected 2024 profits with the 2023 FPL quantities). The American Rescue System (ARP) and Inflation Decline Act contain adjusted the legal guidelines for 2021 for the duration of 2025: Rather of capping subsidy eligibility at an gross sales of 400% of

Subsidies are offered during at bare minimum 2025 in

the poverty stage, the ARP makes sure that residences with profits over that place will not include in the direction of pay out excess than 8.5% of their profits for the benchmark application. If the benchmark program rates additional than 8.5% of product sales, a subsidy is offered, no matter of how substantial the funds is. Hence the ARP and Inflation Decline Act account for the reality that finish-charge fitness insurance coverage charges are significantly substantial within some elements than in just other parts, and are substantial for more mature enrollees. Subsidies are offered during at bare minimum 2025 in

the direction of delicate out All those variations

the direction of delicate out All those variations. However if a residence producing additional than 400% of the poverty place can pay out complete value for the benchmark system and it gained’t rate even further than 8.5% of their gross sales, there is continue to no subsidy obtainable. And back, the preceding yr’s FPL stats are applied in direction of Compute high quality subsidy ranges. For illustration, if by yourself implement for a 2024 Obamacare program for the duration of open up enrollment inside the slide of 2023, OR if by yourself put into practice for 2024 insurance coverage within

mid-2024 employing a exceptional enrollment period of time brought about as a result of a qualifying lifestyle occasion, by yourself’ll employ the service of the FPL statistics in opposition to 2023. That’s mainly because open up enrollment for 2024 insurance plan will be carried out inside late 2023 and Pretty early 2024, prior to the 2024 FPL quantities will develop into readily available. For regularity, the exact same FPL figures are utilized for the comprehensive insurance 12 months, as a result they carry on in direction of be applied for us citizens who enroll throughout distinctive enrollment occasions, even the

moment the refreshing poverty position quantities incorporate been created

moment the refreshing poverty position quantities incorporate been created. The clean FPL quantities appear out each and every calendar year within mid-late January, yet they aren’t made use of for subsidy eligibility determinations right until open up enrollment starts back in just November, for insurance plan thriving the immediately after calendar year (they do get started in direction of be applied in just simply a pair weeks, Unfortunately, in the direction of Work out eligibility for Medicaid and CHIP). While there is no higher sales decrease for subsidy eligibility in between 2021 and 2025, there is even now a very

low lower: *

low lower: * Within just says that contain expanded Medicaid (greatest of the nation), Medicaid is readily available in direction of older people below age 65 with a home funds of up toward 138% of FPL. Subsidy eligibility starts off more than that place. * Within just claims that incorporate not expanded Medicaid, subsidies are obtainable if profits is at minimal 100% of the poverty stage. For reference, listed here are the 2024 funds stages that correlate with people percentages of the 2023 FPL (the limitations are superior within just Alaska and Hawaii): * Family members of just one: 138%

of FPL is $20,120, and 100% of FPL is $14,580 * House of 4: 138% of FPL is $41,400, and 100% of FPL is $30,000 Top quality subsidies are not offered if loved ones dollars is less than the poverty position, until a individual is a present immigrant. Within just 10 says that comprise not expanded Medicaid, this achievement within just a insurance policy hole for countless reduced-cash citizens: They are not qualified for Medicaid mainly because their nation hasn’t authorized Medicaid growth, and they are not qualified for top quality subsidies due to the fact their funds is right

💡 Frequently Asked Questions

How Do I Employ for the High quality Tax Credit history Exercise Coverage Subsidy?

Answer coming soon. We are working on detailed responses to this common question.

Will I Qualify for the Subsidy?

Answer coming soon. We are working on detailed responses to this common question.

How Substantially Will My Subsidy Be?

Answer coming soon. We are working on detailed responses to this common question.

Can I Preserve Dollars Through Getting a Less costly Method, or Really should I Get the Benchmark Software?

Answer coming soon. We are working on detailed responses to this common question.

Do I Consist of toward Be reluctant Right until I Report My Taxes toward Acquire the Subsidy Considering the fact that It’s a Tax Credit score?

Answer coming soon. We are working on detailed responses to this common question.

How Do I Order the Revenue?

Answer coming soon. We are working on detailed responses to this common question.

What Else Do I Want In direction of Understand Relating to How the Exercise Coverage Subsidy Performs?

Answer coming soon. We are working on detailed responses to this common question.

⭐ Expert Tips

-

Include seasonal or trendy variations to keep your meals exciting.

-

Highlight prep shortcuts or time-saving techniques for busy cooks.

-

Consider dietary restrictions and include substitution suggestions.

✅ Key Takeaways

-

These dinner ideas are perfect for impressing guests or enjoying special occasions.

-

Choose recipes that match your skill level and available kitchen tools.

-

Presentation and taste both contribute to a memorable dining experience.

📣 Join Our Community

Want more inspiration like this? Subscribe to our newsletter for weekly dinner ideas and cooking tips!